What is Bankruptcy?

Bankruptcy is a constitutional right that individuals and businesses have to liquidate or partly eliminate their debts. Bankruptcy is a Federal process that is filed in Federal court but State Laws will play an important factor in determining the outcome of your bankruptcy filing. Miami Bankruptcy Lawyer, Ariel Sagre understands the Florida Statutes and Case Law that govern asset protection in Bankruptcy. Mr. Sagre is equipped to help you take advantage of every available protection offered to individuals and businesses seeking to file bankruptcy in South Florida.

The most common forms of bankruptcy filed are Chapter 7 and Chapter 13. Depending on what your intended goals are for filing for bankruptcy protection, Miami Bankruptcy Attorney Ariel Sagre will assist you in choosing the right chapter for you.

Our Fees

A Price you Can Afford

Our founding principle of providing value to our Clients remains as strong as ever. Most Clients will be charged according to our low fixed-rate schedule. Only in extraordinary circumstances, will more attorneys fees be required, and these will be disclosed during your free initial consultation.

We have developed a fair pricing schedule that everyone can afford. Furthermore, we will open your file with a small down payment and the remainder of the balance can be paid in up to 6 months.

Chapter 7 Bankruptcy

- Married couples filing jointly, add $200.

- Plus Court Fees

Chapter 13 Bankruptcy

- Deposit to File Case

- Plus Court Fees

Bankruptcy Can Help

Are you facing foreclosure?

Is your License Suspended?

Are Bill Collector’s Harassing you?

Are your wages being garnished?

STOP Debt Phone Calls

STOP Foreclosure

STOP Wage Garnishments

RECOVER a Suspended License

Chapter 7 Bankruptcy

A chapter 7 bankruptcy is the form of bankruptcy that most consumers file. Its purpose is to eliminate overwhelming debt, which may include credit card debt, bank loans, medical bills, most court judgments, and deficiencies on repossessed vehicles.

The good news is that if you file a Chapter 7 consumer Bankruptcy, most actions against you, including garnishment, foreclosure, bank restraint, lawsuits, and harassment by creditors, cease immediately. One of the main purposes of Bankruptcy Law is to give a person, who is hopelessly burdened with debt, a fresh start by wiping out his or her debts.

IS IT DIFFICULT TO FILE CHAPTER 7 UNDER THE NEW BANKRUPTCY LAWS?

No. There has been much negativity written about the new laws and how much more difficult it's going to be to file Chapter 7. It's true that there are more hoops to jump through under the new laws and it's true that the bankruptcy means test will result in some people having to file chapter 13 instead of Chapter 7. However, for the vast majority of filers Chapter 7 is still available with very little extra effort!

WILL MY CREDITORS STOP HARASSING ME?

Yes, they will! By law, all actions against a debtor must cease once the documents are filed. Creditors cannot initiate or continue any lawsuits, wage garnishments, or even telephone calls demanding payments. Secured creditors such as banks holding a lien on a car, will get the stay lifted if you cannot make payments.

I WAS BANKRUPT BEFORE. WHEN CAN I FILE AGAIN?

A person can file Chapter 7 again if it has been more than 8 years since he or she was discharged from the previous Chapter 7 bankruptcy.

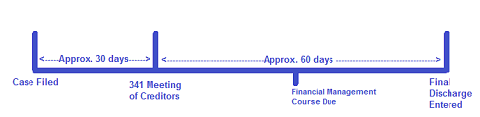

Timeline of a Typical Chapter 7 Bankruptcy

DO YOU HAVE MORE QUESTIONS?

Call us today for your free Bankruptcy Evaluation (305) 266-5999.

The Attorney will answer all of the questions that you might have regarding Chapter 7

Bankruptcy and can help you file your case in Miami-Dade, Broward or Monroe

County.

What is Chapter 13 Bankruptcy?

Chapter 13 Bankruptcy, also known as an “individual reorganization”, is appropriate for use in the following three situations.

The first situation is when an individual is facing a foreclosure sale and is going to lose their home. In this situation, a Chapter 13 bankruptcy may allow you to keep your home, cancel the foreclosure sale, and repay the past due amount on the mortgage over a period of sixty months. Chapter 13 offers many excellent opportunities to potentially remove second and third mortgages and reduce the principle owed on non-homestead real property and automobiles that are upside down in value.

The second situation is when you own property that is not exempt, and you want to keep the property, but do not have the money to pay a lump sum to a Chapter 13 Trustee. In this situation, the Chapter 13 bankruptcy may allow you to pay the value of the non-exempt asset over a 36-60 month period. As an example, you own an automobile that is fully paid, and is worth $10,000.00 . You have $85,000.00 in credit card and medical bills. In a Chapter 7 bankruptcy, you would have to pay the Chapter 7 Trustee a lump sum of approximately $9,000.00 in order to keep the car. However, in a Chapter 13 bankruptcy, you may be able to pay the Trustee $150.00 per month for 60 months and discharge the $75,000.00 in unsecured debt.

The third situation is if your monthly income exceeds the amount allowed under the means test. In this case, you would not be allowed to file a Chapter 7 bankruptcy and would have to file a Chapter 13 bankruptcy. Pursuant to the changes in the bankruptcy laws that became effective in October of 2005, your monthly income determines the type of bankruptcy you can file if you have primarily consumer debts.

The attorney is available to answer any questions you may have. Contact us at (305) 266-5999 for your Free Chapter 13 Bankruptcy Evaluation. The Lawyer can help you file your Chapter 13 Bankruptcy Case in Miami Dade, Broward and Monroe

Wage Garnishment Lawyer

If you have been served with a writ of garnishment or believe that one is coming soon, it is important that you contact a Wage Garnishment Lawyer in Miami, Florida to take advantage of every legal option that is available to you.

Many people are wondering, "How do I stop a Wage Garnishment?". Obtaining legal counsel from a Wage Garnishment Attorney is the first step.

You have two options. The attorney will go to court on your behalf to vigorously defend your valid claim of exemption to cease to have your wages garnished.

If this is not an option, Miami Bankruptcy Attorney, Ariel Sagre can assist you in filing a Bankruptcy that will immediately stop the garnishing of your wages.

If you are ready to take the next step in preserving your wages, call (305) 266-5999 to consult with Ariel Sagre about your Wage Garnishment.